What Is a Manulife One Mortgage?

A Practical Explanation for Homeowners

If you’ve been researching ways to pay off your mortgage faster, you may have come across something called a Manulife One mortgage.

It’s often described as:

an “all-in-one mortgage”

an “offset” mortgage

a mortgage combined with a line of credit

or a different way to manage debt and cash flow

But those explanations don’t always make it clear how it actually works, or whether it’s even right for you.

This article will walk through what a Manulife One mortgage is, how it’s different from a traditional mortgage or HELOC, and why it’s often used as the foundation to pay off your mortgage faster.

What Is a Manulife One Mortgage?

A Manulife One mortgage is a readvanceable mortgage offered by Manulife Bank of Canada that combines:

your mortgage

a revolving line of credit

and your everyday banking

into one integrated account.

Instead of having:

a mortgage at one institution

a chequing account somewhere else

savings accounts sitting separately

Manulife One brings everything together so your money can work more efficiently.

How Manulife One Is Structured

It’s set up as a custom borrowing limit, secured against your home.

Inside that limit, you can have:

fixed mortgage portions (with set terms and payments)

a revolving portion that functions like a line of credit

everyday banking features, such as bill payments and direct deposit

As you pay down the mortgage principal, your available credit automatically increases (this is known as automatic readvancing).

This automatic feature is one of the key differences between Manulife One and many traditional HELOCs.

Manulife One vs. a Traditional HELOC

Homeowners often ask whether Manulife One is “just a big HELOC.” It’s not.

Here’s a simplified comparison:

Manulife One

Custom mortgage structure with automatic readvancing

Integrated daily banking

Flexible minimum payment requirements

Fairer prepayment penalty calculations

No branch visits required (digital setup and management)

Mortgage agent/broker support and guidance

Traditional HELOC

Often requires separate mortgage and banking accounts

Re-advancing may not be automatic or available at all

Minimum monthly interest payments are required

Banking fees and minimum balances often apply

Typically set up and managed in-branch

This difference in structure is why Manulife One is commonly used for cash-flow-based mortgage strategies to be mortgage free faster.

How Manulife One Supports a Cash-Flow Mortgage Strategy

Manulife One is not a strategy by itself.

It’s a tool that allows a specific strategy to work properly.

Because:

income can be deposited directly into the account

interest is calculated on the daily balance

and leftover money naturally offsets the mortgage

Manulife One makes it possible to use your existing income more efficiently.

This is why it’s often used as the foundation for a cash-flow-based mortgage, which focuses on:

reducing interest earlier

accelerating principal paydown

preserving flexibility

Read more about how a cash-flow mortgage works.

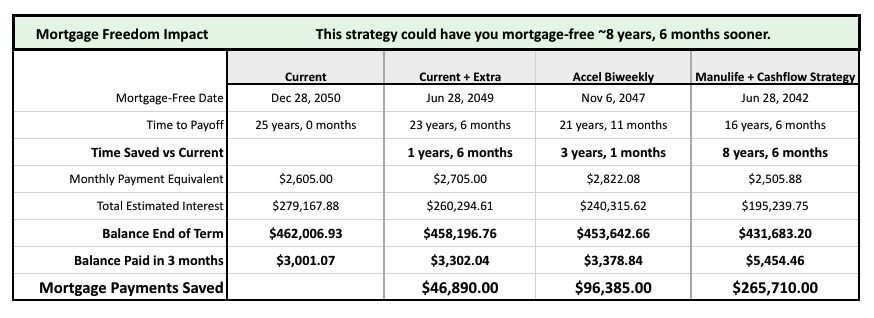

Does Manulife One Actually Save Money?

This is one of the most common questionsm and also one of the biggest misconceptions.

There’s nothing “magical” happening.

The savings come from three very practical factors:

Debt consolidation at a lower secured rate

Efficient use of savings, which reduces interest instead of earning minimal savings interest

Use of excess cash flow, which automatically reduces debt over time

In other words, the numbers can look impressive, but they’re driven by basic math and efficiency, not risk or leverage.

What About the Monthly Fee?

Manulife One has a monthly account fee (currently $16.95, or $9.95 for clients 60+). Sometimes brokers can get this waived for a limited time.

This fee:

covers unlimited daily banking

replaces many separate banking fees

is often outweighed by interest savings

As the saying goes, this is not about “stepping over dollars to pick up pennies.” Using the structure properly, the efficiency gains far exceed the monthly cost.

Is Manulife One Risky?

Used improperly, any credit product can be risky.

Used properly, Manulife One is often less risky than juggling:

multiple high-interest debts

separate banking accounts

rigid mortgage structures

A proper setup typically includes:

fixed mortgage portions for discipline

a flexible portion for cash flow

boundaries around spending

The goal is not to encourage debt, it’s to manage debt more intelligently.

Who Is Manulife One Right for?

Tends to work best for homeowners who:

have equity in their home

have fairly steady income

usually have money left over after expenses

want flexibility and long-term efficiency

It is not designed for:

short-term flipping

speculative investing

lifestyle inflation

or people relying on credit for basic expenses

Fit matters more than features.

The Bigger Picture

Manulife One is not about chasing the lowest rate.

It’s about:

how interest is calculated

how your cash flow is used

and how flexible your mortgage is when life changes

For the right homeowner, it can be a powerful foundation for paying off a mortgage faster.

Want to See How This Would Work With Your Numbers?

Understanding the structure is the first step.

The next step is seeing how it applies to you.