How To Pay Off Your Mortgage Faster in Canada

A Guide to pay off your Mortgage Early:

Most homeowners who want to pay off their mortgage fast are given the same advice:

Just make extra payments.

Make a lump sum when you can.

Switch to accelerated payments.

Be disciplined.

And while those strategies do help, many still feel like their mortgage payoff is moving slower than it should.

The issue usually isn’t effort.

It’s the structure the effort is happening inside.

In this guide, we’ll walk through a different approach, I like to call it a cash-flow first mortgage, and explain how it works, why it can accelerate mortgage payoff, and why flexibility matters more than most people realize.

What Is a Cash-Flow First Mortgage?

It’s about changing how your income flows through your mortgage so it starts working against your balance sooner and more consistently.

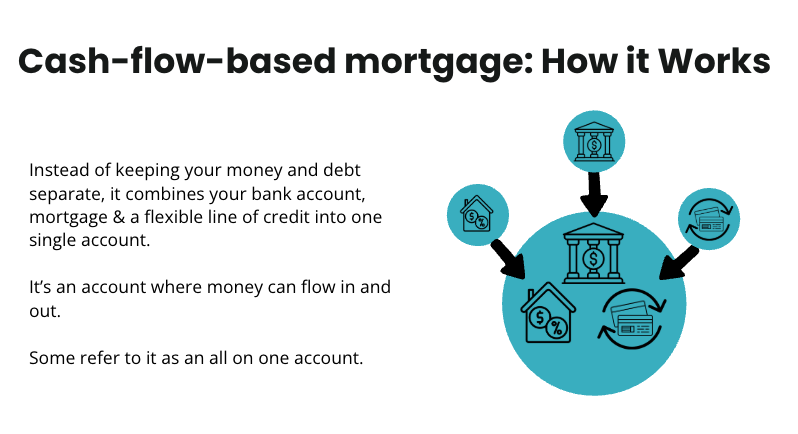

Instead of treating your income, chequing account, and mortgage as completely separate, a cash-flow first mortgage allows your income to temporarily offset your mortgage balance before expenses are paid.

The result:

interest is calculated on a lower balance earlier

progress happens automatically

leftover money naturally acts like a prepayment

flexibility is preserved if life changes

Same income. Same spending. A very different outcome.

Why “Just Make Extra Payments” Often Feels Underwhelming

The problem isn’t that these strategies don’t work. It’s that they work inside a structure that isn’t very efficient.

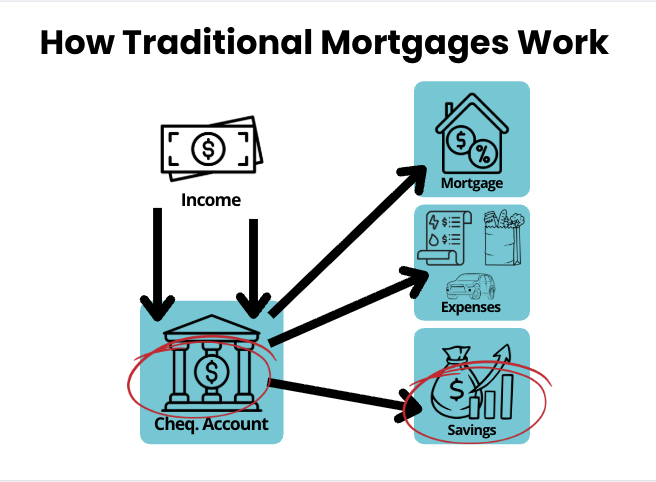

With a traditional mortgage:

Your income goes into a chequing account

Your mortgage lives somewhere else

Interest is charged on the full mortgage balance

Extra payments are manual and planned

Once money goes into the mortgage, it’s usually locked away

That means:

progress depends on discipline and timing

flexibility disappears when you need it most

interest keeps compounding

This is why many responsible homeowners feel like they’re doing everything “right”, but still moving slowly.

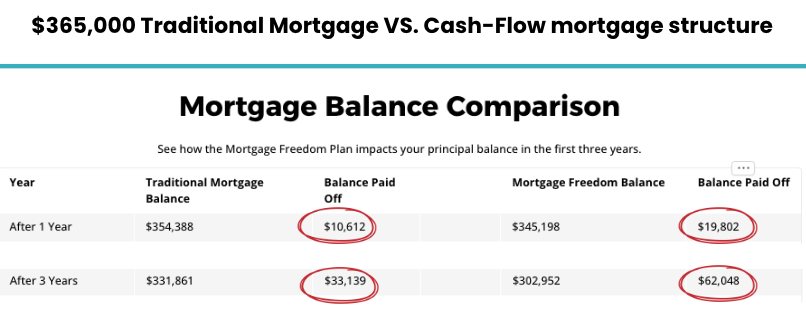

Traditional Mortgage vs. Cash-Flow First Mortgage

Traditional Mortgage

Income and mortgage are separate

Interest charged on full balance

Extra payments require planning

Money becomes locked into equity

Cash-Flow Mortgage (sometimes referred to as an all in one mortgage)

Income temporarily offsets the mortgage balance

Interest calculated on a lower balance sooner

Leftover money acts like a prepayment automatically

Money remains accessible if needed

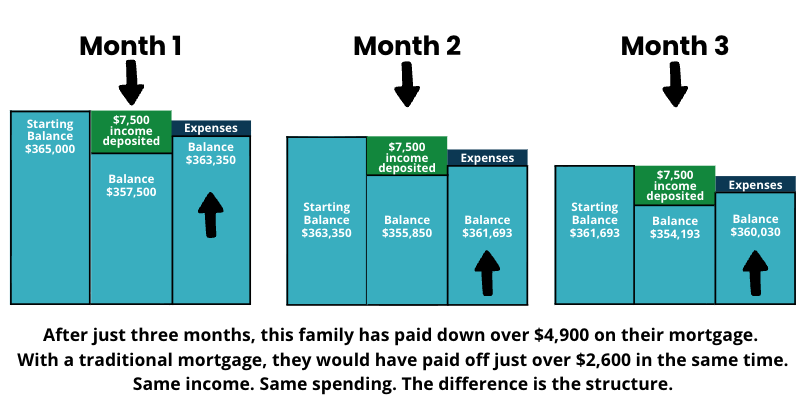

This difference may seem subtle, but over time, it compounds.

How a Cash-Flow First Mortgage Works (Step by Step)

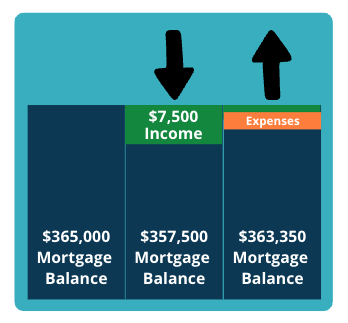

Income comes in - Your paycheque is deposited directly against the mortgage balance.

The balance drops immediately - Interest is calculated on the lower balance right away.

Bills and expenses are paid - Groceries, utilities, insurance (everything still gets paid as normal).

Leftover money stays put - Any money not used for expenses remains in the account and naturally acts like a prepayment.

Nothing is locked in - If you need access to the money later, it’s still available.

This happens every month, AUTOMATICALLY (without needing to remember to make extra payments).

Why This Strategy Pays Down a Mortgage Faster

There are three main reasons this structure works so well.

1. Interest Is Reduced Earlier - Traditional mortgages are front-loaded with interest, especially in the first 10–15 years. By reducing the balance sooner (even temporarily), less interest accumulates over time.

2. Progress Happens Automatically - You don’t need perfect discipline. Your income does the work simply by flowing through the mortgage.

3. Structure Matters More Than Effort - Many homeowners are already disciplined.

But effort inside the wrong structure can only take you so far.

This Is Where Most Plans Fall Apart:

Most mortgage payoff plans assume:

income stays the same

expenses stay predictable

life doesn’t get messy

But real life doesn’t work that way.

Expenses come up. Income fluctuates. Priorities shift.

With a cash-flow first mortgage:

you’re not breaking the plan when a month looks different

you adjust, then continue

progress resumes automatically when things normalize

This is why flexibility isn’t just a nice to have, it’s essential.

Is a Cash-Flow Mortgage the Same as a HELOC?

No, a properly structured cash-flow mortgage:

keeps part of the mortgage fixed for stability

keeps part flexible for cash flow efficiency

How those portions are balanced depends on:

comfort level

income stability

goals

This is where proper setup matters. Two homeowners can use the same structure and get very different results depending on how it’s configured.

Can You Do This at a Traditional Bank?

Some homeowners try to piece this together using multiple accounts.

The challenge is:

it isn’t automatic

it isn’t designed for this purpose

it often becomes frustrating to maintain

That’s why most people who try to DIY this eventually give up.

Certain mortgage products (such as Manulife One) are designed specifically for this type of structure.

Is This Strategy Right for Everyone?

A cash-flow mortgage works best for homeowners who:

own a home with some equity

have fairly steady income

usually have money left over after expenses

value flexibility and clarity

The Bigger Question to Ask Yourself

If you’re currently trying to pay your mortgage off faster, ask yourself:

Is my effort working as efficiently as it could?

Is my mortgage structure helping me, or slowing me down?

What happens if life changes for a few months?

For many homeowners, the answer isn’t to work harder, it’s to work smarter.

Want to See What This Could Look Like for You?

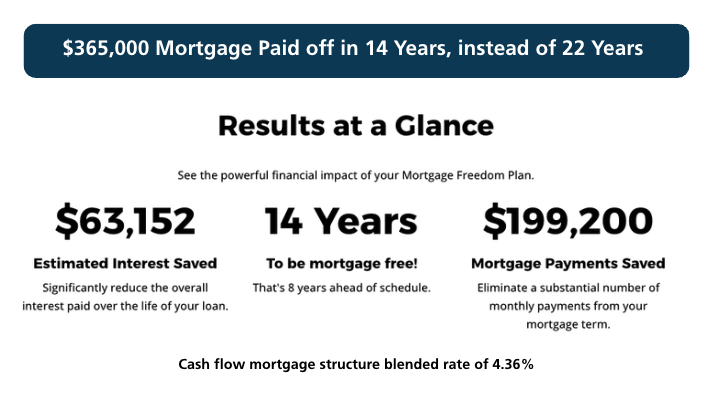

This guide explains the concept, but the real clarity comes from seeing your own numbers.

I recorded a short, free training that walks through:

real household examples

side-by-side comparisons

and how this structure works step by step