Hamilton Mortgage Refinance

Feeling like your mortgage and debts are holding you back? The Cashflow Freedom Plan is designed for homeowners who want to consolidate high-interest debt, improve monthly cash flow, or access the equity in their home - all through a strategy tailored to your life and goals.

Take Control of Your Mortgage & Debt

Refinancing is about creating a financial strategy that works for your situation & lifestyle. Whether you’re frustrated that your payments aren’t making a dent in your balance, or stressed by juggling multiple debts each month, refinancing can reset the balance.

Lower Interest, Boost Cash Flow, Pay Off Faster

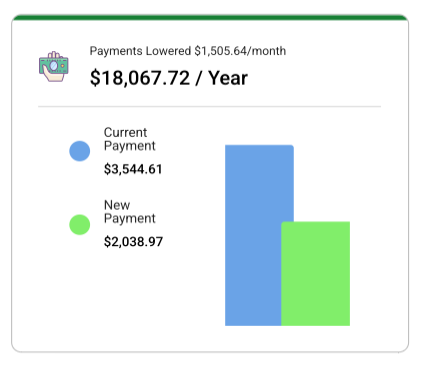

Lower your overall interest costs

Free up monthly cash flow

Focus on one simple payment instead of many

Redirect savings to pay off your mortgage faster

What Is the Cashflow Freedom Plan?

The Cashflow Freedom Plan is my step-by-step refinancing approach designed for homeowners who want to feel in control again. Instead of piecing it together yourself, I build a customized plan that tackles your unique challenges while setting you up for long-term success.

How It Helps Homeowners

Homeowners I work with often feel like their paycheque disappears into debt and interest. With the Cashflow Freedom Plan, we turn your mortgage into a tool for financial growth - helping you reduce debt stress, save money, and move closer to true financial freedom.

Benefits of Refinancing With a Strategy

Consolidate high-interest debt into one payment

Improve monthly cash flow so you can breathe again

Restructure your mortgage to pay it off sooner

Use your home equity to fund renovations, education, or investments

How the Refinance Process Works

Refinancing can feel complicated if you’re trying to figure it out on your own, but my job is to simplify it. Here’s how the Cashflow Freedom Plan works from start to finish:

Step 1: Review Your Mortgage and Debts: We’ll sit down (virtually) to go over your current mortgage, other debts, and monthly cash flow. This gives us a full picture of your situation.

Step 2: Create a Personalized Strategy: I’ll compare refinancing options and design a Cashflow Freedom Plan that improves the amount of money being paid to debts every month, lowers your interest costs, and supports your long-term goals.

Step 3: We Handle the Negotiations: I’ll take care of the paperwork, lender applications, and negotiations on your behalf - saving you time and stress.

Step 4: Implement Your Cashflow Freedom Plan: Once approved, we’ll set up your mortgage and debt structure so your payments work smarter. From there, I’ll guide you on the best ways to stay on track.

Banks vs. Mortgage Brokers: Key Differences

Brokers & Agents: Licensed professionals, wide access to lenders (some big banks included), expertise in debt consolidation, cashflow improvement & mortgage payoff acceleration, guidance through fine print, penalties & mortgage terms, work for your best interests.

Bank: Staff are not licensed in mortgages, limited to only their bank options, focused on shareholder profits, not your long term goals.

A Strategy for Your Future

The right mortgage strategy can save you thousands in interest and years off your mortgage. My focus is on helping you create a clear path toward financial freedom, not just a number on paper.

FAQs

-

Sometimes. But the Cashflow Freedom Plan focuses on the bigger picture - reducing total interest, improving cash flow, and accelerating mortgage payoff.

-

Not necessarily. We structure your refinance to improve cash flow or pay off faster without adding years.

-

Possibly. We work with many of the big banks. You’re not limited to your current lender. I compare multiple lenders in Hamilton to find the best solution for your situation.

-

If you have home equity, high-interest debts, or want to pay off your mortgage faster, a Hamilton mortgage refinance review can reveal options you might not have considered.

-

Yes. An unsecured option would be a bank’s consolidation loan. The challenge with these is that they usually come with higher interest rates compared to a mortgage, and the repayment timelines (amortization) are much shorter. That means the payments often end up being much higher than if those same debts were rolled into your mortgage. In most cases, consolidation loans provide very little cashflow relief compared to your current debt payments.

Our Cashflow Freedom Refinance Plan often makes it possible to pay off all of your debts while keeping your mortgage payment close to what it is now - significantly boosting your monthly cashflow.

-

No. Your credit cards will stay open. In fact, it’s important that you keep them active and continue using them responsibly, as this helps strengthen and improve your credit over time.

-

Yes, it can. When your credit balances rise above 50% of the available limit, your score begins to take a hit. The impact gets even worse once you pass 75% and 90% utilization. By refinancing and paying those balances down to zero, most people see a noticeable improvement in their credit score within just a few months.

-

Not always. If you have a car loan with 0% financing or a student loan with tax-deductible interest, it may make sense to leave those in place. We’ll review your full situation together to decide what’s best.

-

Absolutely. Many clients choose to include funds for home renovations, a new vehicle, travel, or other upcoming expenses. It’s smarter to plan ahead now rather than put those costs on a credit card later.

We also recommend considering contributions to your TFSA, RRSP, or building an emergency fund. Life is unpredictable - we hope for the best, but it’s wise to prepare for the unexpected. -

The only common out-of-pocket cost is an appraisal fee, which ranges from $300–$500 - but in about half of cases, we’re able to avoid this. We’ll always try an online valuation first, which costs just $99 and is often accepted. If a full appraisal is required, some lenders will reimburse that cost and even cover legal fees.

Any other costs, such as a mortgage breakage fee or lawyer fee (if applicable), are usually deducted directly from the refinance proceeds - so not out of pocket.

Contact us

Whether you have a quick question about your mortgage, want a second opinion, or just don’t know where to start - I’d love to hear from you. Send me a message & I’ll get back to you ASAP!

Anything you share here stays confidential. This is just the first step to getting the clarity and confidence you deserve with your mortgage.